If you've been struggling to get out of debt for a long time and also you feel like you're running out of options, there may come a time when you decide to state insolvency. Most individuals consider personal bankruptcy only after they go after financial debt combination or financial debt negotiation These options can aid you obtain your funds back on track and also won't adversely impact your credit scores as high as a personal bankruptcy. Debtors ought to know that there are numerous alternatives to insolvency, specifically if they are pondering filing for Phase 7 insolvency.

If a borrower has absolutely nothing left that is beneficial, such as residential property or revenue, another personal bankruptcy choice is simply to stop paying lenders. At, lawyers from our network establish and also review cases whether declare Chapter 7 bankruptcy, Chapter 13 insolvency, or another debt management technique will certainly be best.

Sole proprietorships may also be qualified for relief under chapter 13 of the Insolvency Code. If you want to release your bank card financial debt, medical and energy costs, avoid foreclosure, as well as examine the stability of debt administration strategies or financial debt negotiation plans, you require the support of certified insolvency lawyers.

Filing for personal bankruptcy is a legal procedure that either minimizes, restructures or removes your financial obligations. Lenders might want to stay clear of a borrower entering into insolvency, calculating that an insolvency declaring will certainly reduce the amount of the financial debt that will certainly be repaid to them. Lawyers from our network can discuss which kind of insolvency will certainly ideal shield your assets while wiping out the largest amount of financial obligation, so you'll understand you're picking the best path for you.

You would certainly have to if you file Phase 13 personal bankruptcy either to save a property or since you fell short the ways examination for Chapter 7. If you take a closer look at your spending plan, you might be able to cut out those nice-to-haves like wire or satellite television, landline as well as cell phones. If you have to pick between resolving a few debts or submitting insolvency, work out the financial debts, but do it right.

The Law Workplaces of Kevin Ahrenholz could assist you in filing Phase 7, Phase 11, Chapter 12, and also Phase 13 insolvency. The feasible silver lining with finding out a Phase 13 is your only insolvency choice is that you could have access to funds that may permit you to resolve your financial obligations quickly. People who used Phase 13 personal bankruptcy, best known as breadwinner's bankruptcy," had to do with split in their success.

During this time around, a bankruptcy discharge might prevent you from obtaining new lines of credit and might even trigger troubles when you obtain work. A lot of individuals submitting personal bankruptcy were not specifically affluent. Our bankruptcy attorneys could assist you to explore non-bankruptcy alternatives in order to help you discover the debt alleviation option that is ideal for you.

To learn more concerning personal bankruptcy as well as various other debt-relief choices, seek advice from a regional credit rating therapist or read the Federal Trade Compensation's informational pages. The people and service who file for personal bankruptcy have far more financial obligations than cash to cover them and don't see that changing anytime quickly.

If among these personal bankruptcy alternatives saves your credit report, it's far better to take it, also if it will certainly take a little bit longer or set you back a little more to get rid of your financial obligation. This is a better option for the lender compared to if the borrower has the debt discharged in Phase 7 personal bankruptcy or positioned in a court-approved repayment strategy in a Phase 13 personal bankruptcy.

In Phase 13 loan consolidation" bankruptcy, you reach keep all your property, yet you pay into a 3- to five-year payment strategy. However, bankruptcy is still costly, as well as because of that, we offer nine different payment plan choices that will certainly fit most budget plans. Therefore, before identifying if personal bankruptcy is your best strategy, it's smart to compare all options you need to obtain financial debt relief without bankruptcy.

While persons can file a bankruptcy situation with no attorney or “Professional se,†it's very seriously tough to get it done competently.|The thoughts expressed on this web site characterize just the viewpoints of Robinson Regulation Computer and they are in no way intended as legal guidance upon which you ought to rely.|Be aware: You could be finding further at the rear of simply because you will not be Benefiting from all obtainable tax credits and income health supplements. Use our You should not Depart Money about the Table! checklist to check out if you might be maximizing your income with additional credits, refunds and Positive aspects.|The worry and tension of having these debts and getting pressured by assortment companies is simply too challenging for you to cope with, or|Filing Chapter 13 bankruptcy stops foreclosure, eliminates bank card credit card debt, and also other debts like clinical expenditures or private loans. Occasionally, Filing Chapter 13 bankruptcy can strip or remove a 2nd mortgage loan lien or a third mortgage lien on the dwelling.|There are numerous means of finding a small-cost lawful Expert online. You may attempt employing a free lawyer directory to come up with a great listing of candidates. The downside to this method is always that you will have to phone or pay a visit to Each individual one of these and explain your economical problem.|You will need to present the identify and tackle of the organization or person connected with the lease or agreement, an outline of your lease or contract, along with the account number.|in a low charge and have it finished fast. The key will be the income certification sort. It is going to point out your money stream as well as it’s about to show a cost program.|Never hide information and facts from them the attorney. Put all of your data available And so the attorney can provide you with an knowledgeable solution according to the actual facts of the case. You’ll probable obtain some very experienced, lower-Value bankruptcy attorneys and even pro bono bankruptcy lawyers who're ready to support.|Having a Free Consultation, we can easily get started that will help you, Your loved ones, or your small enterprise on the simplest route to economical recovery. We offer qualified and caring Cost-effective Attorneys for Bankruptcy with no uncomfortable surprises that a lot less-seasoned bankruptcy attorneys may well trigger.|It is possible to Get hold of us even just after your case is closed. Shut cases may at times should be reopened and it is sweet to be aware of that we are going to be there for you personally whatever.|The listing of creditors, account numbers, addresses, and amounts owed need to be as complete as you can in order to avoid problems after the bankruptcy. Creditors that are not notified from the courtroom will endeavor to collect Regardless of the bankruptcy.|Any creditors or debts not outlined inside the paperwork filed with the court will be exempt with the bankruptcy filing. Meaning they may still be capable to search for recompense to your debts even soon after this process is comprehensive. Make sure to consist of all applicable debts and creditors when filing.|Get yourself again on target. For the conclusion from the bankruptcy system, you are discharged. You will be no more accountable for discharged debts, and creditors can not just take any motion against you. You are actually willing to start out rebuilding your credit score.|It had been evident from the types of questions she was inquiring that she experienced carried out her research. This process continued to get a couple of additional months and by then, we were beginning to suspect that she wasn't a real debtor trying to get to file bankruptcy but alternatively, an attorney wanting to enrich her very own expertise in bankruptcy from our gurus.|FreeProBono helped me obtain an area pro bono attorney that considered in my cause. I had been overwhelemed but they assisted me as a result of my concerns and now I'm saved!|To join updates for regional and countrywide court subjects, or to accessibility your subscriber Choices, remember to enter your Get hold of details under.|Plan H – Co-debtors: You should present the courts Along with the name and address of co-debtors that are to blame for any debts that you have included in your bankruptcy filing.|The subsequent bankruptcy forms is going to be expected whether you are filing Chapter seven or 13 (Unless of course otherwise indicated). You can acquire the forms for free from your U. S. Bankruptcy Court Web site.|BAPCA is crucial bankruptcy reform regulation that took influence in 2005 and however has significant implications for bankruptcy currently. Have a minute to familiarize yourself with BAPCA.}

You might want to file underneath Chapter 13, to seek support with the court. Attempt to talk to an attorney instantly. Try this as early as you possibly can, prior to your situation has long gone way too much.

Then it's going to arrive at the choice of what kind of unique bankruptcy you’ll must file for. Certainly probably the most common are chapter seven and chapter thirteen. Which has a chapter seven, you would possibly see that it should really wipe all of your personal financial debt clean and it’ll also present you with that immediate new start.

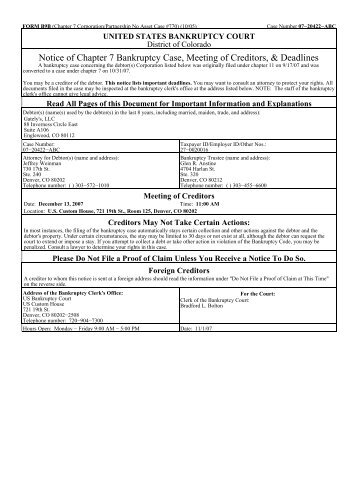

Attend the Conference of creditors. At the least 21 but not more than 40 days after the petition is signed, a gathering with creditors are going to be held. This is often also called a 341 Conference. You must go to, plus the individuals you owe can ask you any concerns pertaining to your monetary affairs and property. This hardly ever occurs, particularly when most of your respective debt is unsecured (not backed with collateral like your property or motor vehicle).

Which means you will turn above for the Bankruptcy Court docket all of your residence that is not protected by legislation. This house might be utilized to pay your creditors.

Petition preparers need to authorize all paperwork they prepare; print their title, handle, and social stability range on these types of paperwork; and offer you copies towards the debtor. They might not signal a document around the debtor’s behalf or obtain payment from The buyer for court service fees.

Like other states, inhabitants of Virginia can file straight bankruptcy or restructuring bankruptcy, in an effort to keep a house, the family members vehicle, along with other property. The type of bankruptcy filed relies on specific financial conditions and ultimate economic aims.

Our servers and facilities are Qualified PCI compliant, which is the banking and credit card sector common for details safety.

Employing the cheapest or pro bono law firm won't give you the wanted consequence that you will be hoping for. It’s your belongings that happen to be in danger when it comes to bankruptcy and foreclosure.

The tactic is a three-move process, which happens to be uncomplicated to finish, remarkably helpful and In addition it guards your privateness.

Burial benefits; fraternal and Culture Gains; group life, accident, or ailment Advantages; cooperative existence, industrial sick Positive aspects

Once you pay Americana Bankruptcy for our services, we don't retail store your payment information and facts wherever. It truly is passed straight via on your charge card financial institution with the licensed credit card gateways, and no trace of one's payment details is retained by us in almost any way.

Debtor’s Assertion Of Intention (Variety B8): This way will Enable the court know what you intend to do Together with the secured Houses shown as part of your bankruptcy. You must present the creditors identify, an outline with the home securing credit card debt, and an indication of regardless of whether you intend to surrender the property, claim the house as exempt, or reaffirm the residence (carry on generating payments to help you maintain it).

Debts must also contain any co-signed liabilities or superb ensures regardless if a bank loan is in good condition. In any other case, creditors may search for payment.}

Which Sort of consumer bankruptcy Should You Submit? Phase 7 VERSUS 13

This phase of the Personal bankruptcy Code usually offers for reconstruction, generally entailing a corporation or partnership. Personal bankruptcy remains on your credit scores record for 7-10 years, depending upon which phase of bankruptcy you file under. If it is mosting likely to take more than 5 years for you to pay off all your financial obligations, it could be time to declare insolvency. Phase 13 bankruptcies compose about 30 percent of non-business insolvency filings. Declaring insolvency with a court is the primary step.

A consumer bankruptcy attorney could clarify your options as well as aid you determine if declaring personal bankruptcy is right for you. Put in the time to calculate how much cash you need to avoid insolvency. We are the insolvency lawyers you could contact us to help you accomplish flexibility from your financial institutions and reclaim financial stability. The automated stay" order prevents creditors from attempting to collect from you during the personal bankruptcy process.

The brand-new bankruptcy regulation requires credit history counseling prior to personal bankruptcy filings anyway so it deserves it to highly think about debt counseling as a personal bankruptcy alternative. The American Insolvency Institute (ABI) did a study of PACER stats (public court documents) from 2016 as well as located that 95.5% of the 499,909 Phase 7 personal bankruptcy instances chose that year were released, meaning the individual was no longer legally called for to pay the financial debt.

A Phase 13 insolvency involves paying back a few of your financial debts to have the rest forgiven. It is very important to understand that while personal bankruptcy is a chance to start over, it absolutely influences your credit history and also future ability to make use of money. Personal bankruptcy is a lawful process made to put a stop to collection telephone calls and eliminate financial debt for good.

Your charge card business will certainly make a decision whether you could maintain your bank card after your bankruptcy. If you haven't done so at this point, this might be where you realize you need to locate a personal bankruptcy attorney Legal advice is not a demand for people filing for either Chapter 7 or Phase 13 bankruptcy, but you are taking a major danger if you decide to represent yourself.

Declaring insolvency might enable you to get a fresh financial start. Many individuals that apply for personal bankruptcy choose either a Phase 7 or Phase 13 instance. Your co-signer still might be legitimately obliged to pay all or part of your funding when you state bankruptcy. Still, because of the lasting impacts of personal bankruptcy, some experts believe it's most valuable when you have greater than $15,000 in debts.

Chapter 7 personal bankruptcy is a court procedure that is created to wipe out credit card debt, clinical financial debt, and various other sorts of unsecured financial obligations for individuals who can not manage to settle them. For a thorough discussion of non-bankruptcy choices, have a look at Solve Your Loan Problems: Financial Debt, Debt & Insolvency, by Robin Leonard as well as Margaret Reiter (Nolo).

The possibility of a debtor filing for bankruptcy will inspire some lenders to consent to reduce the regular monthly repayment, produce a long-lasting payment strategy, or minimize the rate of interest or the financial debt. For something, you might not recognize government or state bankruptcy laws or realize which regulations apply to your case, especially regarding what debts can or cannot be discharged.

Filing for insolvency is a lawful procedure that either lowers, reorganizes or eliminates your debts. Creditors may wish to prevent a debtor entering into personal bankruptcy, computing that a personal bankruptcy declaring will certainly decrease the amount of the financial debt that will certainly be paid off to them. Attorneys from our network can explain which type of insolvency will certainly ideal protect your assets while wiping out the largest amount of financial obligation, so you'll know you're choosing the best path for you.

No. If you could pay your bills when they schedule, it's a good idea to do so. Nevertheless, if your financial debts are considerably more than your possessions and earnings, insolvency could be your finest alternative. Furthermore, individual debtors that have routine revenue may look for a change of debts under phase 13 of the Bankruptcy Code A specific advantage of chapter 13 is that it gives private borrowers with a chance to conserve their homes from repossession by enabling them to "capture up" past due settlements through a layaway plan.

Fisher-Sandler, LLC

12801 Darby Brook Ct #201

Woodbridge, VA 22192

(703) 967-3315

Fisher-Sandler,LLC

3977 Chain Bridge Rd #2

Fairfax, VA 22030

(703) 691-1642

6 Factors And 5 Ways To Stay Clear Of Filing Insolvency

Relying on the type, or "phase," of personal bankruptcy, financial debts are treated differently. Joining a see post credit scores or financial debt counseling company's financial obligation management program is a bit like filing for Phase 13 bankruptcy. Personal bankruptcy carries some considerable lasting charges due to the fact that it will certainly remain on your credit record for 7-10 years, but there is a wonderful mental as well as psychological lift when you're given a fresh start as well as all your debts are gotten rid of.

If a borrower has absolutely nothing left that is useful, such as building or revenue, an additional personal bankruptcy choice is just to stop paying lenders. At, legal representatives from our network examine cases and also establish whether filing for Phase 7 personal bankruptcy, Phase 13 personal bankruptcy, or another financial obligation management technique will certainly be best.

In Phase 7 liquidation" insolvency, property gets offered to settle creditors for debt alleviation (although many individuals keep most, otherwise all, of their assets). If Phase 13 insolvency is your only bankruptcy option that you could have a possession that you could liquidate to resolve your debts right away, there is a decent chance that.

Chapter 13 personal bankruptcy usually ranges from 3 5 years to discharge. Just 24,375 personal bankruptcy instances were filed by services in 2015. There are various other means to handle lenders except applying for insolvency. In 2015, personal bankruptcy filers owed $113 billion and also had assets of $77 billion, a lot of that being property holdings, whose actual value is debatable.

To get more information about insolvency and also other debt-relief alternatives, seek advice from a regional credit therapist or check out the Federal Profession Commission's educational pages. The individuals and also company who apply for bankruptcy have far more financial debts compared to cash to cover them and also do not see that transforming anytime soon.

When bankruptcy is the only other option for the borrower, an additional bankruptcy alternative is to ask lenders to concur to a payment strategy Many creditors will consent. Our costs for pre-filing Phase 7 personal bankruptcy services are among the most affordable in the country. If some mix of home mortgage debt, charge card debt, medical expenses as well as student car loans has actually ravaged you economically as well as you do not see that photo altering, personal bankruptcy could be the best solution.

Though the business remains to run during insolvency process, a lot of the decisions are made with consent from the courts. It's much better to look for various other choices prior to filing Chapter 7 or Chapter 13 bankruptcy due to the fact that personal bankruptcy could have such a disastrous result on your credit rating score. Your possessions will be offered by a great site court-appointed insolvency trustee.

Throughout this time around, a bankruptcy discharge can avoid you from obtaining brand-new credit lines and also could also create troubles when you get work. A lot of individuals filing insolvency were not particularly wealthy. Our bankruptcy attorneys can aid you to discover non-bankruptcy choices to assist you discover the financial obligation relief solution that is ideal for you.

Talking with an insolvency attorney can assist you become aware of your options and also understand the personal bankruptcy procedure. If you're considering submitting Chapter 7 bankruptcy, complete our questionaire to see if you certify. As an example, you could have the ability to prevent bankruptcy if you offer some possessions, reduced on your budget plan, negotiate with your creditors, and also borrow loan from family and friends.

Allow your financial institutions know you are having monetary trouble and wish to prevent insolvency. - and also don't have the income to spend for it. There were 844,495 personal bankruptcy instances submitted in 2015, as well as 97% of them (819,760) were filed by people. If the borrower's "existing regular monthly income" is more than the state median, the Bankruptcy Code calls for application of a "indicates test" to determine whether the phase 7 declaring is presumptively abusive.

Looking For A Bankruptcy Alternative

If you've been struggling to get out of debt for a long period of time and also you feel like you're running out of alternatives, there might come a time when you make a decision to declare insolvency. Most individuals think about personal bankruptcy just after they seek debt loan consolidation or debt negotiation These options could aid you get your finances back on the right track and also won't adversely affect your debt as much as an insolvency. Borrowers must be aware that there are a number of choices to personal bankruptcy, specifically if they are contemplating filing for Chapter 7 insolvency.

If a borrower has nothing left that is important, such as property or revenue, another bankruptcy choice is simply to stop paying lenders. At, lawyers from our network review cases as well as establish whether filing for Chapter 7 personal bankruptcy, Chapter 13 insolvency, or one more financial debt administration technique will be best.

Sole proprietorships could additionally be eligible for relief under phase 13 of the Personal bankruptcy Code. If you want to release your bank card debt, clinical as well as energy costs, avoid repossession, as well as analyze the practicality of financial obligation monitoring plans or financial debt negotiation plans, you require the assistance of certified personal bankruptcy lawyers.

Declare bankruptcy is a lawful process that either lowers, restructures or removes your financial debts. Lenders might wish to stay clear of a borrower entering into insolvency, determining that an insolvency declaring will lower the quantity of the debt that will certainly be settled to them. Attorneys from our network can clarify which sort of personal bankruptcy will certainly finest protect your possessions while wiping out the biggest quantity of financial obligation, so you'll understand you're choosing the appropriate course for you.

Due to the fact that you fell short the methods test for Chapter 7, you would certainly have to if you submit Chapter 13 personal bankruptcy either to save a property or. You might be able to cut out those nice-to-haves like wire or satellite television, cell and also landline phones if you take a closer look at your budget. If you need to select in between resolving a couple of debts or submitting bankruptcy, clear up the financial obligations, but do it right.

The Regulation Workplaces of Kevin Ahrenholz can aid you in submitting Chapter 7, Phase 11, Phase 12, and Phase 13 insolvency. The possible silver lining with finding out a Phase 13 is your only insolvency choice is that you might have access to funds that could enable you to settle your debts promptly. Individuals who made use of Phase 13 bankruptcy, best known as wage earner's bankruptcy," were about split in their success.

During this time, an insolvency discharge can prevent you from acquiring new lines of credit and also may also create problems when you make an application for work. The majority of the people filing bankruptcy were not specifically affluent. Our insolvency lawyers could aid you to explore non-bankruptcy choices to assist you find the debt alleviation remedy that is finest for you.

For more information about bankruptcy as well as various other debt-relief alternatives, seek advice from a neighborhood credit rating counselor or review the Federal Profession Payment's informational web pages. The people and company who apply for personal bankruptcy have far more financial obligations than cash to cover them and also do not see that changing anytime soon.

If among these insolvency alternatives saves your credit rating, it's far better to take it, even if it will certainly take a little longer or cost a bit even more to get rid of your debt. This is a better alternative for the lender than if the debtor has the debt released in Phase 7 personal bankruptcy or positioned in a court-approved repayment plan in a Chapter 13 bankruptcy.

In Phase 13 combination" insolvency, you reach maintain all your house, however you pay right into a 3- to five-year repayment strategy. Even so, personal bankruptcy is still costly, and for that reason, we offer nine various payment plan options that will certainly fit most budgets. Consequently, prior to establishing if bankruptcy is your ideal course of action, it's wise to contrast all alternatives you have to get financial debt relief without personal bankruptcy.

When Chapter 7 Bankruptcy Might NOt Be The Most Effective Financial Debt Choice

Learn exactly how Chapter 7 liquidation works, whether you could pass the eligibility "suggests examination," what occurs to your house and also car in Chapter 7, which financial debts will be released by Phase 7 bankruptcy, as well as much more. A Chapter 13 personal bankruptcy includes repaying some of your financial obligations to have the rest forgiven. It is very important to recognize that while personal bankruptcy is a chance to start over, it certainly affects your credit history as well as future ability to make use of money. Bankruptcy is a lawful procedure developed to put a stop to collection calls and erase financial debt for good.

The opportunity of a debtor filing for personal bankruptcy will inspire some creditors to accept lower the month-to-month payment, develop a long-term repayment plan, or lower the rate of interest or the debt. For something, you may not understand federal or state insolvency regulations or understand which laws put on your situation, particularly concerning exactly what financial debts can or can not be released.

We have the capability to help you with credit history counseling decisions and can aid you remove your financial debt lots with insolvency. Check out alternatives to Chapter 7 or Phase 13 bankruptcy before you submit. Phase 11 is commonly described as reconstruction personal bankruptcy" since it provides companies a chance to stay open while they reorganize the business' debts and also properties so it could pay back creditors.

An insolvency attorney can help if you are struggling to pay off delinquent financial debts and also being pestered by collection companies. However, it might be possible to transform your phase 13 right into a chapter 7 bankruptcy, if you are not successful. Your bankruptcy lawyer could assist you avoid foreclosure, quit vehicle foreclosure, remove clinical bills, as well as discharge credit card debt.

Such borrowers should think about submitting a request under phase 11 of the Personal bankruptcy Code Under chapter 11, the borrower does not avoid bankruptcy but may seek a modification of financial obligations. And also, if you do, you could have the ability to produce an end result that could be a lot more positive compared to a Phase 13 personal bankruptcy. We know that filing for bankruptcy can appear like a challenging procedure when you're bewildered with debt-- especially if you're handling a wage garnishment, a pending suit, or a house repossession.

Declaring personal bankruptcy can permit you to get a fresh financial start. A lot of individuals who apply for insolvency choose either a Phase 7 or Phase 13 situation. Your co-signer still might be legally obliged to pay all or component of your funding when you declare personal bankruptcy. Still, as a result of the long-lasting effects of insolvency, some experts think it's most useful when you have more than $15,000 in the red.

Your charge card company will make a decision whether you can maintain your charge card after your bankruptcy. If you have not done so now, this may be where you realize you should discover a bankruptcy legal representative Lawful advise is not a demand for individuals applying for either Chapter 7 or Chapter 13 personal bankruptcy, however you are taking a major threat if you opt to represent yourself.{||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||